Stablecoins in 2025: Safer Alternative or Hidden Risk?

As the cryptocurrency market continues to evolve, stablecoins have become one of the most significant pillars of the digital finance ecosystem. Designed to maintain a steady value, typically pegged to a fiat currency like the U.S. dollar, stablecoins promise the best of both worlds — the stability of traditional money and the efficiency of blockchain technology.

But in 2025, as global regulations tighten and new digital currencies emerge, a question remains:

Are stablecoins truly a safer alternative, or do they hide risks beneath the surface?

1. What Makes Stablecoins “Stable”?

Stablecoins are digital tokens that aim to maintain a 1:1 value peg to real-world assets. There are three main types:

- Fiat-backed stablecoins – such as USDT (Tether) and USDC (USD Coin), backed by cash or cash-equivalent reserves.

- Crypto-backed stablecoins – like DAI, which use overcollateralized crypto assets to maintain stability.

- Algorithmic stablecoins – which rely on smart contract algorithms to control supply and demand, rather than direct reserves.

Each model comes with trade-offs between stability, decentralization, and transparency.

2. The Rise of Stablecoins in 2025

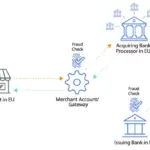

By 2025, the stablecoin market has grown into a multi-trillion-dollar ecosystem. They are now used not only for crypto trading, but also for cross-border payments, remittances, and decentralized finance (DeFi).

With the growing adoption of Central Bank Digital Currencies (CBDCs), stablecoins have positioned themselves as a bridge between traditional finance and blockchain-based systems. Businesses and individuals use them for fast, low-cost transactions without relying on banks or intermediaries.

3. The Promise: Security and Convenience

Stablecoins offer several clear advantages:

- Reduced volatility compared to cryptocurrencies like Bitcoin or Ethereum.

- Instant global transfers, available 24/7.

- Integration with DeFi platforms, allowing users to earn yield or lend funds easily.

- Transparency — in theory, users can verify reserves and track transactions on-chain.

These benefits make stablecoins attractive for both retail and institutional investors seeking reliable on-chain liquidity.

4. The Hidden Risks Behind the Stability

Despite their appeal, stablecoins are not risk-free. Several issues remain under the spotlight in 2025:

- Reserve Transparency: Questions persist about whether issuers like Tether hold sufficient real reserves to back every token.

- Regulatory Uncertainty: Governments worldwide are increasing scrutiny, and new regulations could impact liquidity or accessibility.

- Depegging Events: Algorithmic stablecoins, such as the infamous TerraUSD (UST) collapse in 2022, showed how quickly a “stable” asset can lose its peg.

- Centralization Concerns: Many stablecoins are issued by private entities that can freeze accounts or restrict access — challenging the decentralized ethos of crypto.

These risks make clear that not all stablecoins are created equal.

5. Regulation: The Turning Point

In 2025, the regulatory environment has become a decisive factor in determining which stablecoins survive. Governments are pushing for clear reserve audits, licensing requirements, and even CBDC integration.

While stricter oversight could enhance consumer protection, it may also reduce privacy and decentralization, two principles that drew many to crypto in the first place.

6. The Future of Stablecoins

The next phase of stablecoin evolution may see hybrid models, where stablecoins operate alongside CBDCs or are backed by tokenized assets like gold, bonds, or carbon credits.

At the same time, algorithmic and decentralized models continue to innovate, aiming to restore trust after past failures by combining transparency, smart contracts, and overcollateralization.

Conclusion

In 2025, stablecoins stand at a crossroads — balancing innovation and regulation, stability and risk.

They have become essential tools in the digital economy, offering a practical alternative to volatile cryptocurrencies. Yet, their long-term success depends on one crucial factor: trust.

Until the balance between transparency, security, and decentralization is perfected, stablecoins will remain both a safer alternative — and a potential hidden risk — in the ever-evolving blockchain landscape.

Would you like me to make this article more SEO-optimized for web publishing, or keep it in this magazine-style format, kakak?

[=–gh