The relationship between banks and fintechs has evolved dramatically over the past decade — from cautious competition to strategic collaboration. In 2025, this partnership-driven approach has become the new norm, reshaping the financial ecosystem across payments, lending, digital identity, and customer experience. Here’s how these collaborations are redefining the industry and where the biggest opportunities lie.

1. From Competitors to Collaborators

In the early days of fintech, many startups were seen as disruptors threatening the traditional banking model. Fast-forward to 2025, and both sides have realized they’re stronger together.

- Banks bring trust, regulatory compliance, and large customer bases.

- Fintechs offer agility, innovation, and cutting-edge technology.

This complementary relationship has led to a surge of partnerships aimed at blending stability with innovation.

2. The Rise of “Banking-as-a-Service” (BaaS)

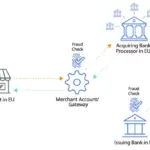

One of the biggest trends in 2025 is the expansion of Banking-as-a-Service platforms. Through BaaS, fintechs can leverage a bank’s infrastructure — such as licenses, compliance systems, and payment rails — to build and scale financial products faster.

For banks, these partnerships open new revenue streams without needing to build every technology in-house. Institutions like J.P. Morgan, Standard Chartered, and DBS Bank have all expanded their BaaS offerings to power fintechs across Asia, Europe, and the U.S.

3. Embedded Finance: Banking Beyond the Bank

Fintechs are also helping banks go “invisible” — integrating financial services into non-financial platforms. This concept, known as embedded finance, allows users to access credit, insurance, or payments within apps they already use.

For example:

- E-commerce platforms can now offer instant credit via bank-fintech APIs.

- Ride-hailing apps and gig platforms integrate savings or insurance products from partner banks.

- Super apps like Grab and Paytm collaborate with banks to deliver micro-loans and investment products.

This integration gives banks new digital touchpoints, while fintechs gain the infrastructure needed to scale securely.

4. AI and Data Collaboration Take Center Stage

Data sharing and AI-driven analytics have become the backbone of 2025’s partnerships. Fintechs specializing in AI credit scoring, fraud detection, and personalized financial insights are helping banks serve customers more intelligently.

For instance:

- Banks use fintech-powered AI models to analyze real-time spending and offer tailored loan approvals.

- Fintechs like Tink, Plaid, and Truelayer enable secure data-sharing under open banking regulations, enhancing personalization while maintaining compliance.

This synergy accelerates innovation while maintaining the high security and trust customers expect from traditional financial institutions.

5. Regulatory Technology (RegTech) Partnerships

With regulations becoming more complex, many banks have turned to fintechs for RegTech solutions. These technologies automate compliance tasks, manage anti-money laundering (AML) checks, and ensure transparency in digital transactions.

In 2025, partnerships between banks and RegTech providers have reduced compliance costs and improved reporting accuracy — freeing up time for banks to focus on customer engagement and product innovation.

6. Case Studies: Collaboration in Action

- Revolut × Citi: Citi now provides global banking infrastructure to Revolut’s cross-border services, allowing faster international transfers.

- Standard Chartered × Thought Machine: This partnership helps modernize core banking systems with cloud-native architecture.

- Maybank × Finexus: A Southeast Asian example where a local fintech supports digital payment ecosystems and eKYC processes.

These alliances are not just technological — they’re strategic, allowing both entities to share insights, customer data, and product development pipelines.

7. Challenges That Still Remain

Despite the progress, collaboration isn’t always seamless. Common challenges include:

- Data privacy concerns when sharing customer information.

- Integration issues between legacy bank systems and new fintech APIs.

- Regulatory hurdles, especially across borders.

However, advancements in API standardization and the rise of global frameworks like ISO 20022 are helping bridge these gaps.

8. The Future: Collaborative Innovation Ecosystems

As we move deeper into 2025 and beyond, bank-fintech partnerships are evolving into broader innovation ecosystems. These ecosystems include not only financial institutions but also technology firms, regulators, and consumer platforms — all working toward a seamless, digital-first financial future.

The line between banks and fintechs is blurring fast. In this new landscape, collaboration isn’t just an option — it’s the foundation for staying competitive and relevant.

Conclusion

The fintech revolution is no longer about disruption — it’s about collaboration. In 2025, banks and fintechs are co-creating the future of finance: one that’s faster, smarter, and more inclusive. By leveraging each other’s strengths, they’re delivering the kind of innovation that benefits not just institutions, but everyday consumers around the world.